Are you looking to take your business to the next level and expand your network of investors? Look no further than business investment communities! These communities provide a unique opportunity for entrepreneurs to connect with like-minded individuals, share ideas, and secure funding for their ventures. In this article, we will explore the world of business investment communities and how they can benefit your business. Business investment communities act as a bridge between entrepreneurs looking for funding and investors seeking promising opportunities. By joining these communities, you can tap into a vast network of potential investors who are eager to support innovative business ideas. One of the key benefits of business investment communities is the opportunity to exchange knowledge and expertise with other entrepreneurs. By participating in discussions, workshops, and events, you can gain valuable insights that can help you grow your business. Business investment communities provide access to a diverse range of funding opportunities, including angel investors, venture capitalists, and crowdfunding platforms. By showcasing your business to these investors, you can secure the funding you need to take your venture to the next level. Networking is essential for business growth, and business investment communities offer a unique platform to connect with potential partners, clients, and mentors. By building relationships within these communities, you can open doors to new opportunities and collaborations. Business investment communities often host workshops, seminars, and training sessions to help entrepreneurs enhance their skills and knowledge. By participating in these programs, you can sharpen your business acumen and stay ahead of industry trends. Before joining a business investment community, it’s essential to research and identify reputable organizations that align with your business goals. Look for communities that have a track record of successful investments and a strong network of investors. Once you’ve joined a business investment community, make sure to engage and participate actively in discussions, events, and networking opportunities. By showcasing your passion and dedication, you can attract potential investors and collaborators to your venture. Business investment communities thrive on collaboration and feedback. Be open to receiving constructive criticism and suggestions from fellow entrepreneurs and investors. By incorporating feedback into your business strategy, you can refine your ideas and increase your chances of success. Business investment communities offer a wealth of opportunities for entrepreneurs to connect, learn, and secure funding for their ventures. By joining these communities and actively participating, you can take your business to new heights and achieve your entrepreneurial dreams. So, what are you waiting for? Dive into the world of business investment communities and unlock the power of collaboration and growth! Are you looking to take your business to the next level and expand your network of investors? Look no further than business investment communities! These communities provide a unique opportunity for entrepreneurs to connect with like-minded individuals, share ideas, and secure funding for their ventures. In this article, we will explore the world of business investment communities and how they can benefit your business. Business investment communities act as a bridge between entrepreneurs looking for funding and investors seeking promising opportunities. By joining these communities, you can tap into a vast network of potential investors who are eager to support innovative business ideas. One of the key benefits of business investment communities is the opportunity to exchange knowledge and expertise with other entrepreneurs. By participating in discussions, workshops, and events, you can gain valuable insights that can help you grow your business. Business investment communities provide access to a diverse range of funding opportunities, including angel investors, venture capitalists, and crowdfunding platforms. By showcasing your business to these investors, you can secure the funding you need to take your venture to the next level. Networking is essential for business growth, and business investment communities offer a unique platform to connect with potential partners, clients, and mentors. By building relationships within these communities, you can open doors to new opportunities and collaborations. Business investment communities often host workshops, seminars, and training sessions to help entrepreneurs enhance their skills and knowledge. By participating in these programs, you can sharpen your business acumen and stay ahead of industry trends. Before joining a business investment community, it’s essential to research and identify reputable organizations that align with your business goals. Look for communities that have a track record of successful investments and a strong network of investors. Once you’ve joined a business investment community, make sure to engage and participate actively in discussions, events, and networking opportunities. By showcasing your passion and dedication, you can attract potential investors and collaborators to your venture. Business investment communities thrive on collaboration and feedback. Be open to receiving constructive criticism and suggestions from fellow entrepreneurs and investors. By incorporating feedback into your business strategy, you can refine your ideas and increase your chances of success. Business investment communities offer a wealth of opportunities for entrepreneurs to connect, learn, and secure funding for their ventures. By joining these communities and actively participating, you can take your business to new heights and achieve your entrepreneurial dreams. So, what are you waiting for? Dive into the world of business investment communities and unlock the power of collaboration and growth!

The Rise of Business Investment Communities

Connecting Entrepreneurs and Investors

Facilitating Knowledge Sharing

Benefits of Joining Business Investment Communities

Access to Funding Opportunities

Networking Opportunities

Learning and Development

How to Get Started with Business Investment Communities

Research and Identify Reputable Communities

Engage and Participate Actively

Be Open to Feedback and Collaboration

Conclusion

The Rise of Business Investment Communities

Connecting Entrepreneurs and Investors

Facilitating Knowledge Sharing

Benefits of Joining Business Investment Communities

Access to Funding Opportunities

Networking Opportunities

Learning and Development

How to Get Started with Business Investment Communities

Research and Identify Reputable Communities

Engage and Participate Actively

Be Open to Feedback and Collaboration

Conclusion

Author Archives: admin

Revolutionize Your Startup’s Finances: A Comprehensive Guide

Financial management is the backbone of any successful startup. It involves planning, organizing, and controlling the financial activities of a business to ensure long-term sustainability. Effective financial management helps startups make informed decisions, allocate resources efficiently, and achieve their business goals. Startups must develop a detailed budget that outlines their income and expenses. By accurately forecasting financial needs, startups can avoid cash flow problems and make strategic investments. Zero-based budgeting requires startups to justify every expense from scratch, ensuring that resources are allocated to the most critical activities. This approach encourages cost-consciousness and efficiency. Bootstrapping involves funding a startup using personal savings or revenue generated by the business. While it provides autonomy and control, it may limit growth opportunities. Venture capital is a form of financing provided by investors to startups with high growth potential. In exchange for funding, venture capitalists typically receive equity in the company. Cash flow is the movement of money in and out of a business. Startups must carefully manage cash flow to ensure they have enough liquidity to cover expenses and seize growth opportunities. By monitoring cash flow regularly and identifying trends, startups can make proactive financial decisions and avoid cash crunches. Startups can leverage different types of debt, such as loans or lines of credit, to finance operations or investments. It is essential to understand the terms and implications of each debt option. Startups should prioritize high-interest debts and consider refinancing options to reduce interest costs. Developing a debt repayment plan can help manage debt effectively. Startups may be eligible for various tax credits, such as research and development credits or small business credits, to reduce their tax liability. Taking advantage of these credits can improve cash flow. Consulting with tax experts can help startups optimize their tax strategies and ensure compliance with tax laws. Proper tax planning can maximize deductions and minimize tax obligations. Financial reporting involves analyzing and presenting financial information to stakeholders, such as investors or lenders. Accurate and transparent financial reporting builds trust and credibility with external parties. Startups should implement robust financial reporting systems to track performance, identify trends, and make data-driven decisions. Investing in growth opportunities involves taking calculated risks to expand the business. Startups should assess risks carefully and develop risk management strategies to mitigate potential downsides. Startups must evaluate the return on investment for various growth initiatives to determine their profitability and impact on the business. Monitoring key performance indicators can help measure success. Startups should recruit skilled professionals, such as accountants or financial analysts, to oversee financial operations and provide strategic guidance. A strong financial team can enhance decision-making and financial performance. Investing in training and development programs for financial staff can improve their skills and keep them updated on industry best practices. Continuous learning fosters a culture of innovation and excellence. By prioritizing financial management, budgeting effectively, exploring funding options, and investing strategically, startups can set a solid foundation for sustainable growth and success. Building a strong financial infrastructure is key to navigating challenges and capitalizing on opportunities in today’s competitive business landscape. Financial management is the backbone of any successful startup. It involves planning, organizing, and controlling the financial activities of a business to ensure long-term sustainability. Effective financial management helps startups make informed decisions, allocate resources efficiently, and achieve their business goals. Startups must develop a detailed budget that outlines their income and expenses. By accurately forecasting financial needs, startups can avoid cash flow problems and make strategic investments. Zero-based budgeting requires startups to justify every expense from scratch, ensuring that resources are allocated to the most critical activities. This approach encourages cost-consciousness and efficiency. Bootstrapping involves funding a startup using personal savings or revenue generated by the business. While it provides autonomy and control, it may limit growth opportunities. Venture capital is a form of financing provided by investors to startups with high growth potential. In exchange for funding, venture capitalists typically receive equity in the company. Cash flow is the movement of money in and out of a business. Startups must carefully manage cash flow to ensure they have enough liquidity to cover expenses and seize growth opportunities. By monitoring cash flow regularly and identifying trends, startups can make proactive financial decisions and avoid cash crunches. Startups can leverage different types of debt, such as loans or lines of credit, to finance operations or investments. It is essential to understand the terms and implications of each debt option. Startups should prioritize high-interest debts and consider refinancing options to reduce interest costs. Developing a debt repayment plan can help manage debt effectively. Startups may be eligible for various tax credits, such as research and development credits or small business credits, to reduce their tax liability. Taking advantage of these credits can improve cash flow. Consulting with tax experts can help startups optimize their tax strategies and ensure compliance with tax laws. Proper tax planning can maximize deductions and minimize tax obligations. Financial reporting involves analyzing and presenting financial information to stakeholders, such as investors or lenders. Accurate and transparent financial reporting builds trust and credibility with external parties. Startups should implement robust financial reporting systems to track performance, identify trends, and make data-driven decisions. Investing in growth opportunities involves taking calculated risks to expand the business. Startups should assess risks carefully and develop risk management strategies to mitigate potential downsides. Startups must evaluate the return on investment for various growth initiatives to determine their profitability and impact on the business. Monitoring key performance indicators can help measure success. Startups should recruit skilled professionals, such as accountants or financial analysts, to oversee financial operations and provide strategic guidance. A strong financial team can enhance decision-making and financial performance. Investing in training and development programs for financial staff can improve their skills and keep them updated on industry best practices. Continuous learning fosters a culture of innovation and excellence. By prioritizing financial management, budgeting effectively, exploring funding options, and investing strategically, startups can set a solid foundation for sustainable growth and success. Building a strong financial infrastructure is key to navigating challenges and capitalizing on opportunities in today’s competitive business landscape.

1. Importance of Financial Management

2. Budgeting Techniques for Startups

Creating a Realistic Budget

Implementing Zero-Based Budgeting

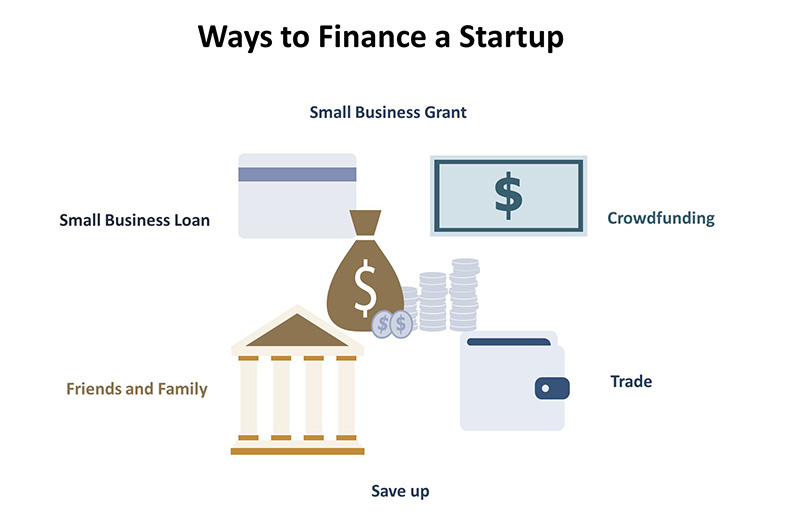

3. Funding Options for Startups

Bootstrapping

Venture Capital

4. Understanding Cash Flow

5. Managing Debt Wisely

Types of Debt

Debt Repayment Strategies

6. Tax Strategies for Startups

Utilizing Tax Credits

Seeking Professional Advice

7. Importance of Financial Reporting

8. Investing in Growth

Risk Management

Measuring Return on Investment

9. Building a Financial Team

Hiring Financial Professionals

Training and Development

10. Conclusion

1. Importance of Financial Management

2. Budgeting Techniques for Startups

Creating a Realistic Budget

Implementing Zero-Based Budgeting

3. Funding Options for Startups

Bootstrapping

Venture Capital

4. Understanding Cash Flow

5. Managing Debt Wisely

Types of Debt

Debt Repayment Strategies

6. Tax Strategies for Startups

Utilizing Tax Credits

Seeking Professional Advice

7. Importance of Financial Reporting

8. Investing in Growth

Risk Management

Measuring Return on Investment

9. Building a Financial Team

Hiring Financial Professionals

Training and Development

10. Conclusion